Markets Week Ahead: S&P 500, Gold, US Dollar, Powell, BOE, Japan Inflation, RBA Minutes

Equity markets across the world experienced an increase in value, reaching a peak of 14 months. This was accompanied by a decrease in the value of the US dollar, which reached its lowest point in one month. These changes were driven by optimism regarding the possibility that interest rates in the United States may have reached their maximum level, as well as hopes for additional stimulus measures from China.

Over the course of the week, various stock market indices experienced notable gains. The MSCI All Country World index rose by 0.6%, while the S&P 500 and Nasdaq 100 indices saw jumps of 2.6% and 3.8%, respectively. Additionally, the German DAX 40 advanced by 2.5% and the UK FTSE 100 rose by 1.0%. In Asia, the Hang Seng index rose by 3.3% and Japan’s Nikkei 225 experienced a significant surge of 4.5%. Within the realm of currency exchange rates, risk-sensitive currencies such as the Australian dollar and New Zealand dollar rose by approximately 1.9% and 1.7%, respectively, throughout the week.

On Wednesday, the US Federal Reserve made the decision to maintain the current interest rates. Nevertheless, they indicated that there may be a need for further rate increases of up to 50 basis points, due to a slower than anticipated moderation in inflation and the resilience of the US economy. Despite this indication, market sentiment suggests skepticism regarding future Fed interest rate hikes, with less than 100% probability of one hike this year and potential rate cuts as soon as next year. Investors will look to Fed Chair Powell’s upcoming speech for an explanation on why such a dovish pricing is justified.

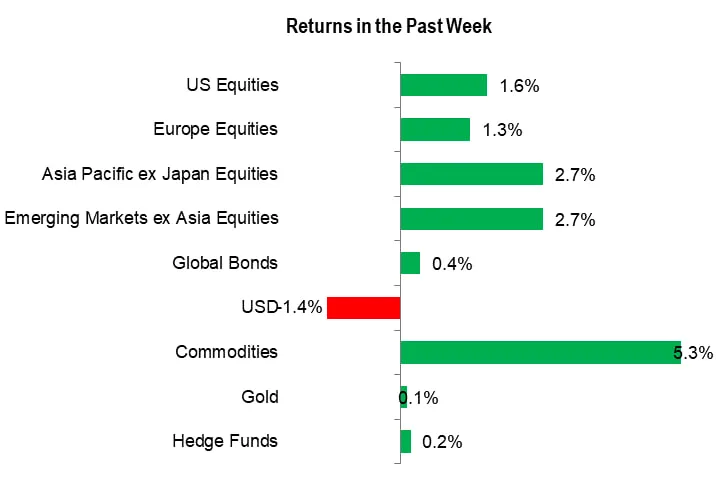

Past week market performance

Source Data: Bloomberg; chart prepared in excel

Source Data: Bloomberg; chart prepared in excel The Bloomberg Global Aggregate Total Return Index Unhedged USD, BBG Commodity Total Return, and HFRX Global Hedge Fund Index are utilized as proxies for global bonds, commodities, and hedge funds, respectively.

On Thursday, the European Central Bank elevated interest rates to a level that has not been seen for over twenty years. This was done in response to the continued presence of high inflation, and it was indicated that more rate increases could occur in the future. The ECB has forecasted that inflation will remain above its desired target of 2% until at least the end of 2025.

China has recently decreased certain policy rates, in contrast to other central banks who are increasing them. This has raised expectations of additional stimulus measures in the future to aid the delicate economic recovery. The release of data earlier this week revealed that China’s industrial output in May was slower than anticipated, retail sales growth was lower than predicted, and fixed asset investment in the first five months of 2023 expanded less than expected. There have been reports in the media that Beijing is contemplating the issuance of special treasury bonds worth approximately one trillion yuan. This move is intended to support local governments with debt and encourage confidence among businesses.

The upcoming week will feature a series of speeches from the Federal Reserve, including one by Powell. The US markets will be closed on Monday in observance of a holiday. Tuesday’s schedule includes the release of RBA minutes from their June meeting and a speech by Bullard from the US Federal Reserve. On Wednesday, Japan Reuters Tankan and BOJ monetary policy meeting minutes, UK CPI for May, and Canada retail sales for April are set to be released. Thursday will see the release of BOE interest rate decision as well as speeches from Goolsbee, Mester, and Powell from the US Federal Reserve. Finally, on Friday, Japan’s inflation data for May, UK retail sales for May, and speeches from Bullard and Bostic of the Federal Reserve are scheduled.

Forecasts:

- The US dollar’s outlook for the upcoming week is negative due to increased bearish bets after the Federal Reserve’s hawkish pause. The DXY index has fallen below a key support level, suggesting that there may be a difference between the market’s expectations and the central bank’s objectives.

- The EUR/USD currency pair is expected to go up due to a breakout indicating a bullish trend. Analysts doubt that the Federal Reserve will resume tightening and predict that the European Central Bank will need to control inflation, leading to a potential increase in the exchange rate in the short term.

- The British Pound is expected to continue gaining value due to upcoming economic events such as the UK CPI and BOE Rate Call. The Pound has already reached its highest value in 14 months compared to the US Dollar.

- The Australian dollar has gone up in value due to the devaluation of the US dollar and domestic events. It is uncertain whether this trend will continue.

- The S&P 500 and Nasdaq could experience a slowdown in their positive momentum due to concerns from Federal Reserve members about inflation and the need for higher interest rates. However, there is little economic data expected to be released and volatility is projected to remain low.

- The gold market is uncertain due to the bears’ inability to push prices below a certain level. Despite actions by the Federal Reserve, market participants are not responding. The week has ended with no clear answers and the possibility of a retest of $2000/oz remains open.